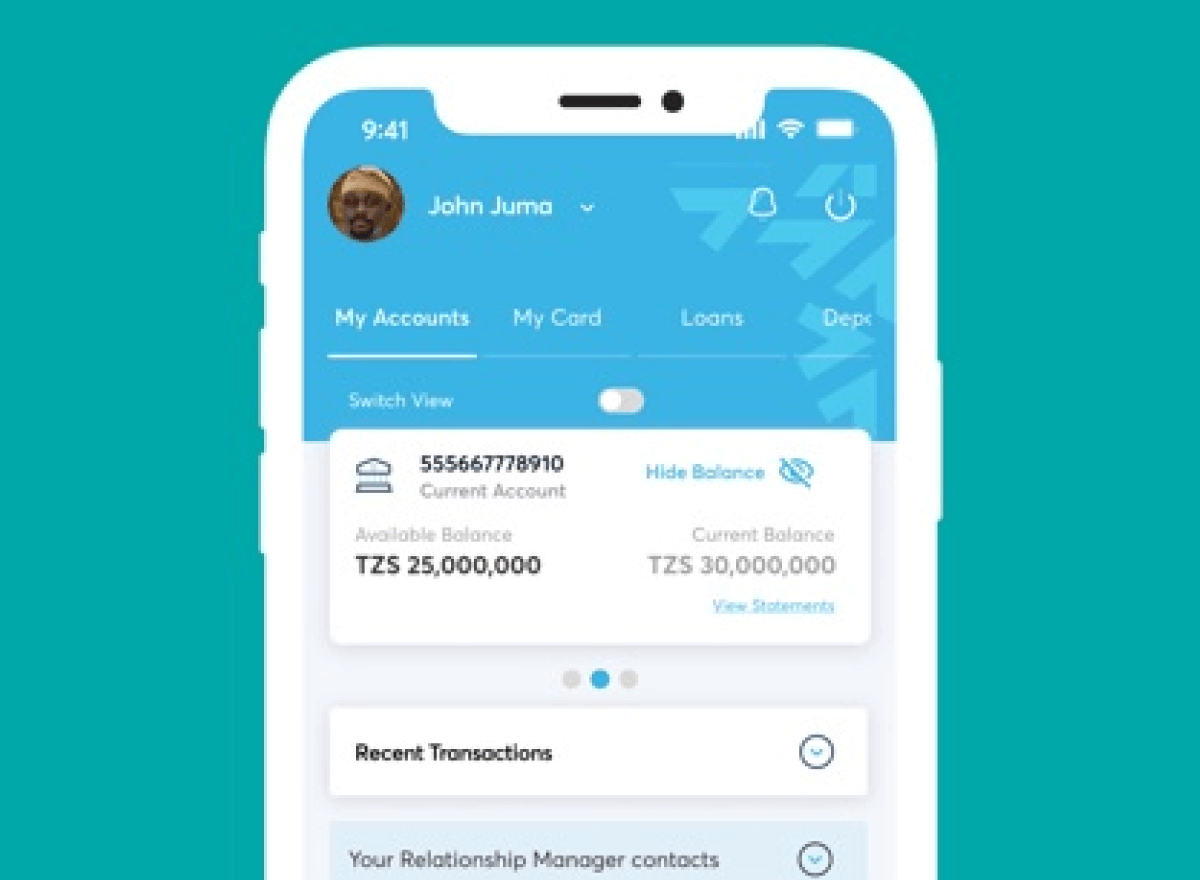

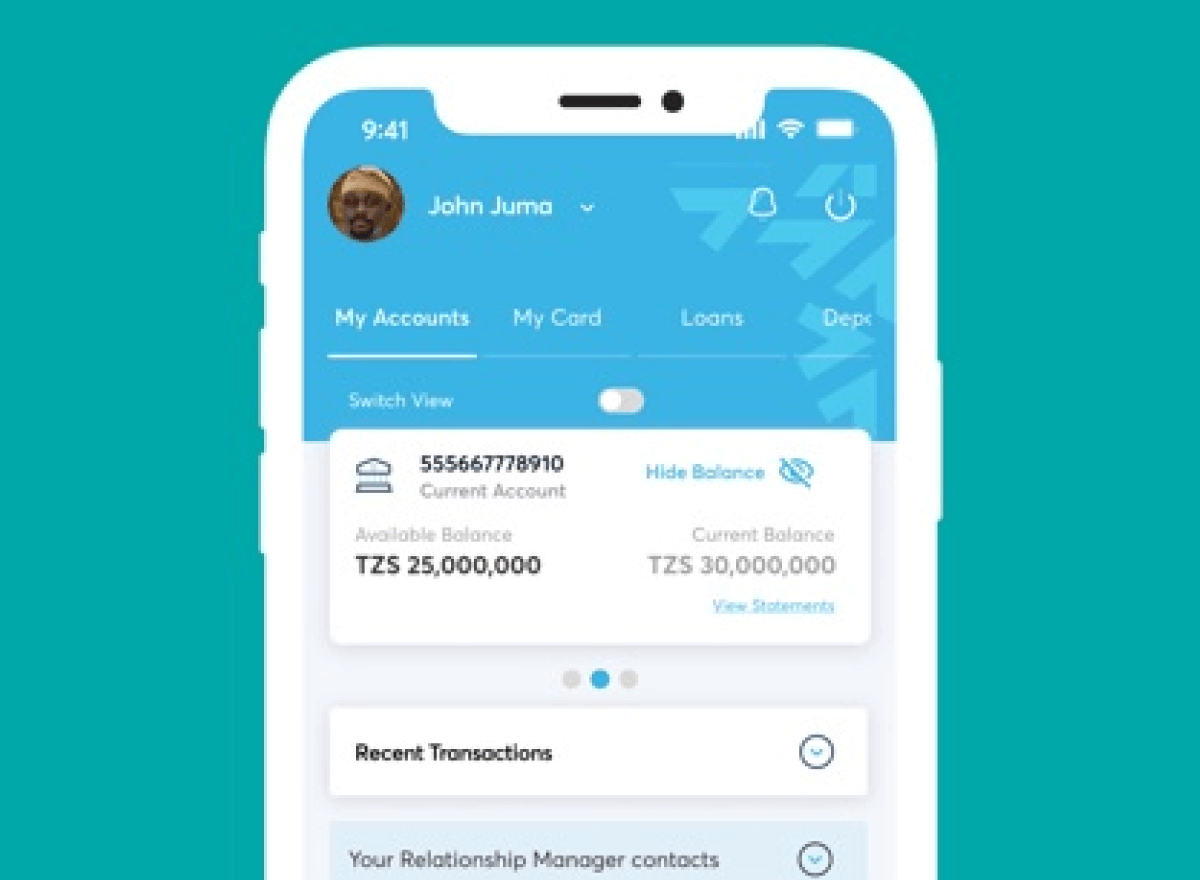

NCBA Now Mobile App

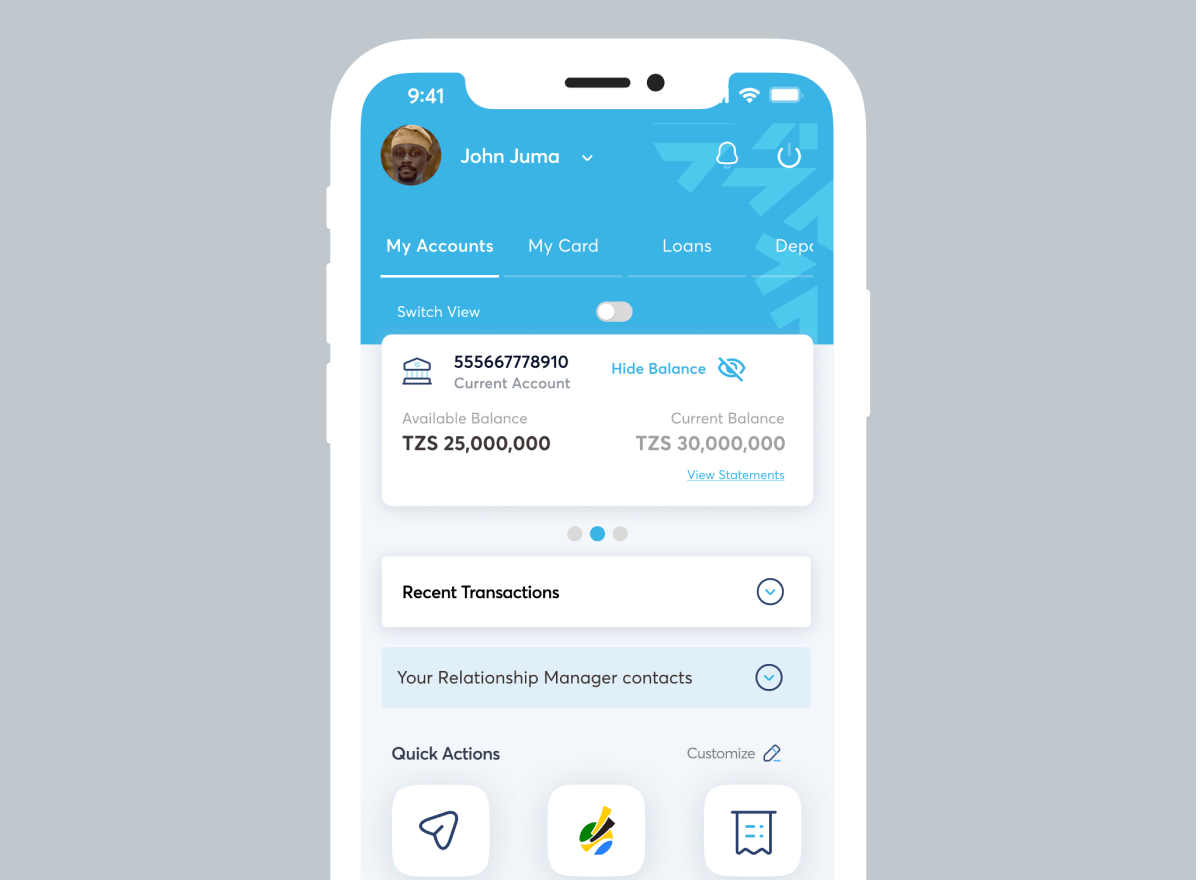

Big news—opening your NCBA personal current account is now fully digital with the NCBA Now app. No queues. No paperwork. Just a few taps and you’re in. From sign-up to everyday banking—like payments, transfers, bill payments, and real-time account tracking—NCBA Now gives you the full power of a bank, right in your pocket. Smarter, faster, more secure. Welcome to banking built for the way you live.

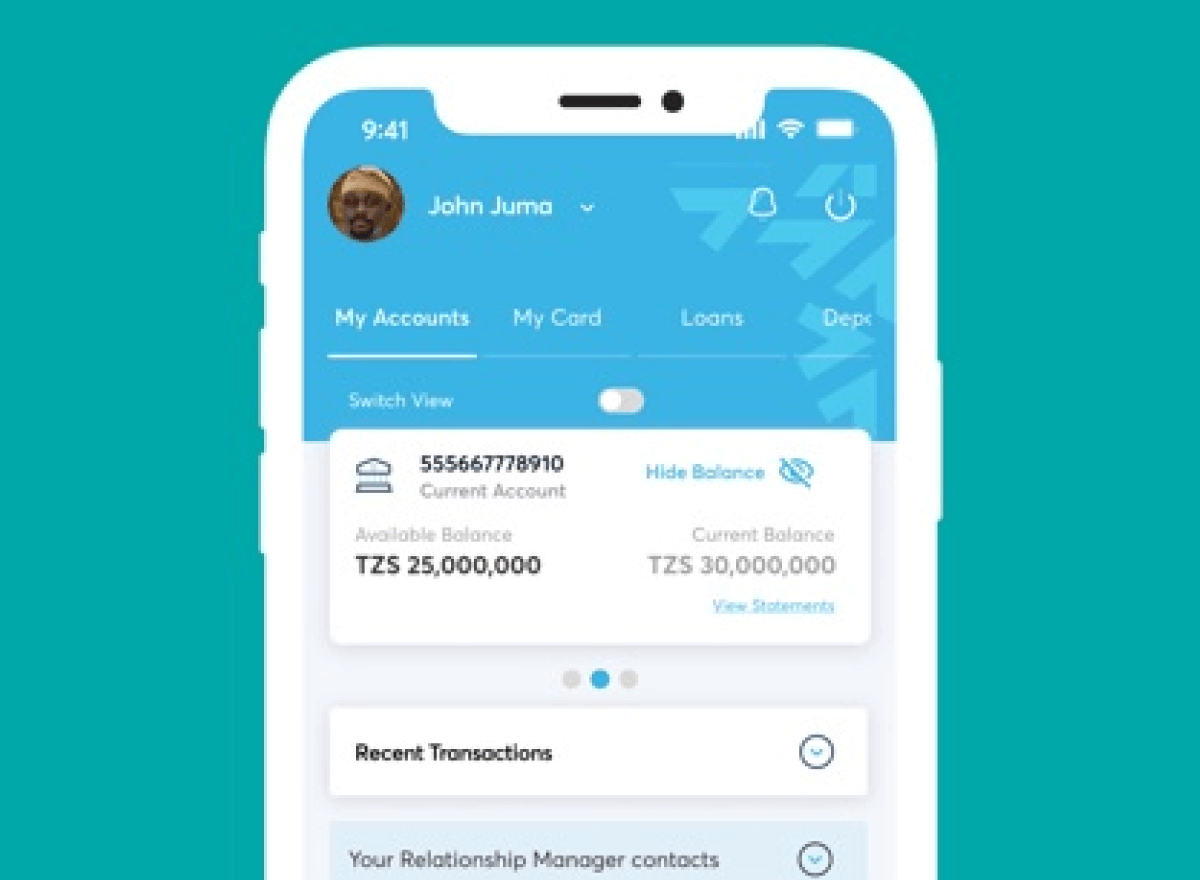

Real-Time Balance Updates

Instantly track your account balances and transactions, keeping you in control of your money.

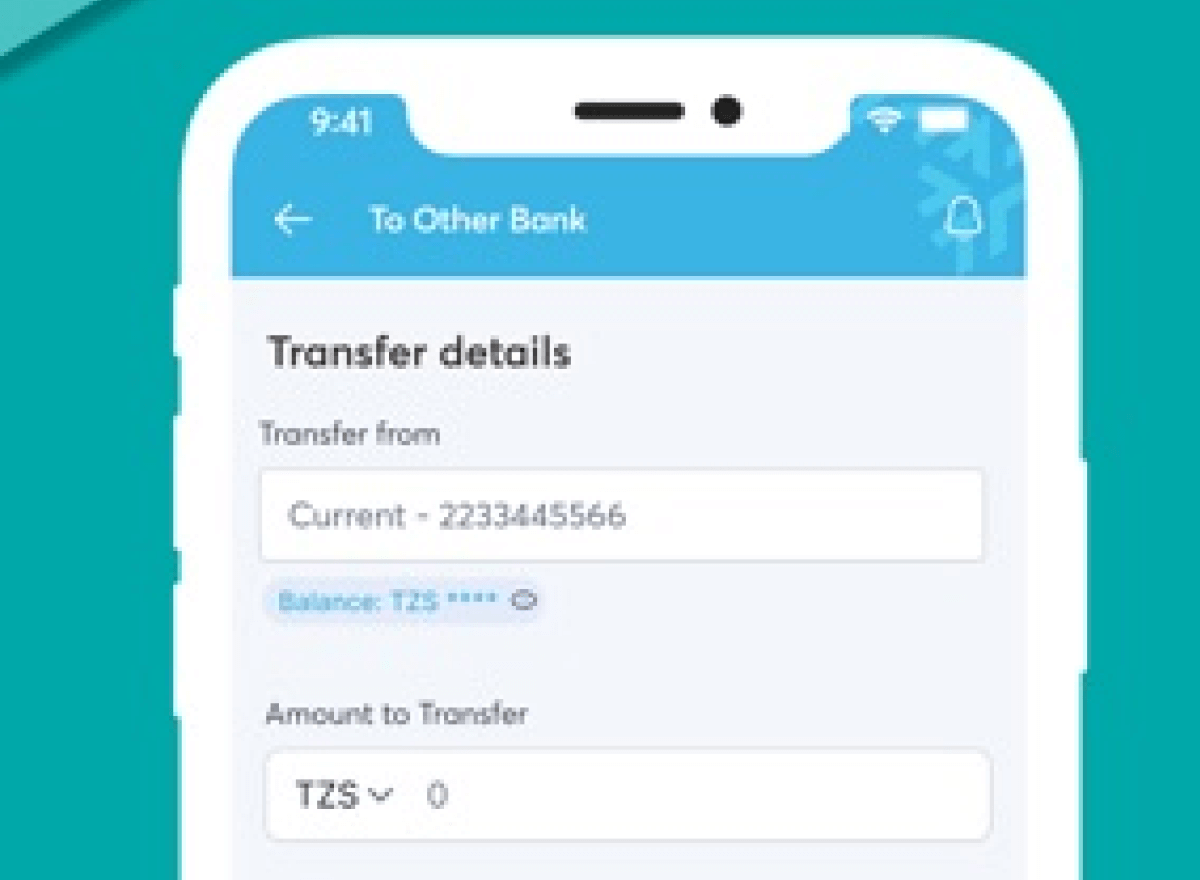

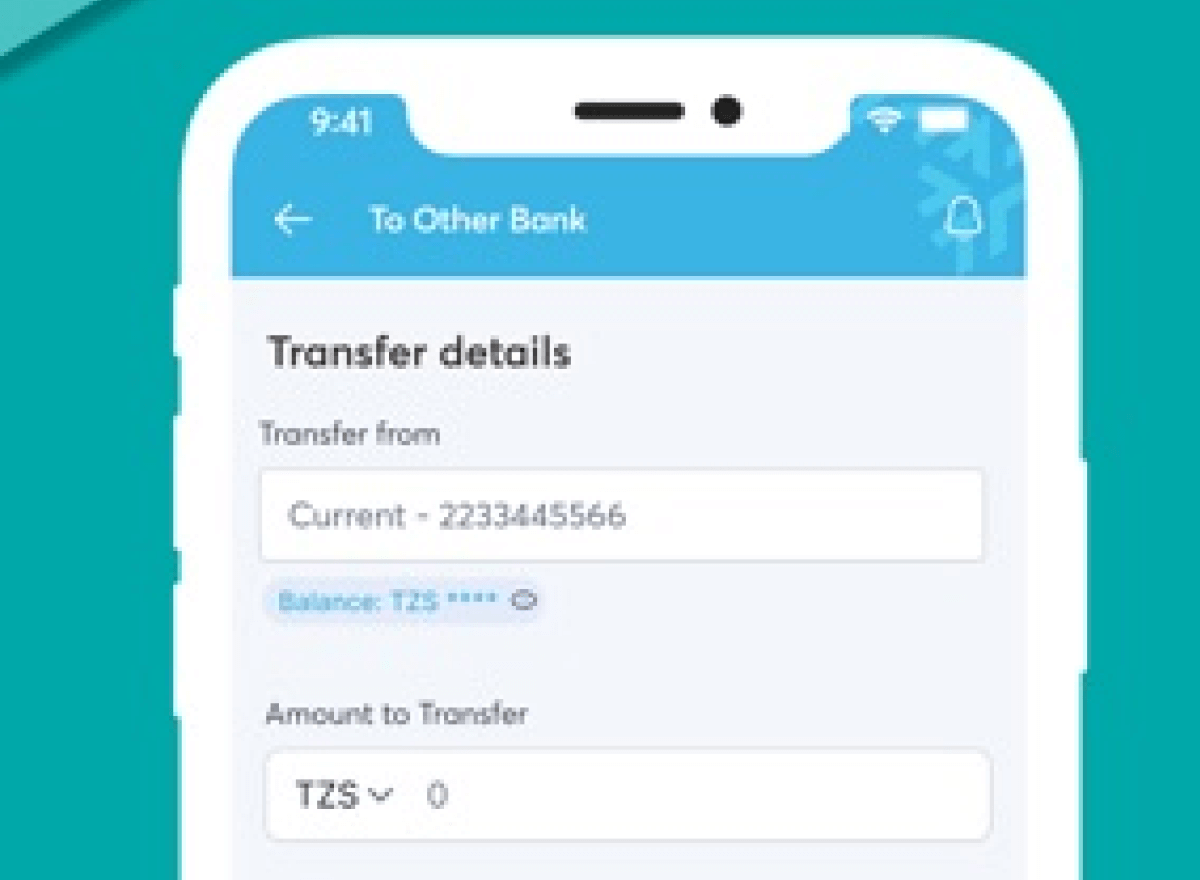

Seamless Money Transfers

Send funds between NCBA accounts, other banks, or mobile wallets like M-Pesa and Airtel Money in seconds.

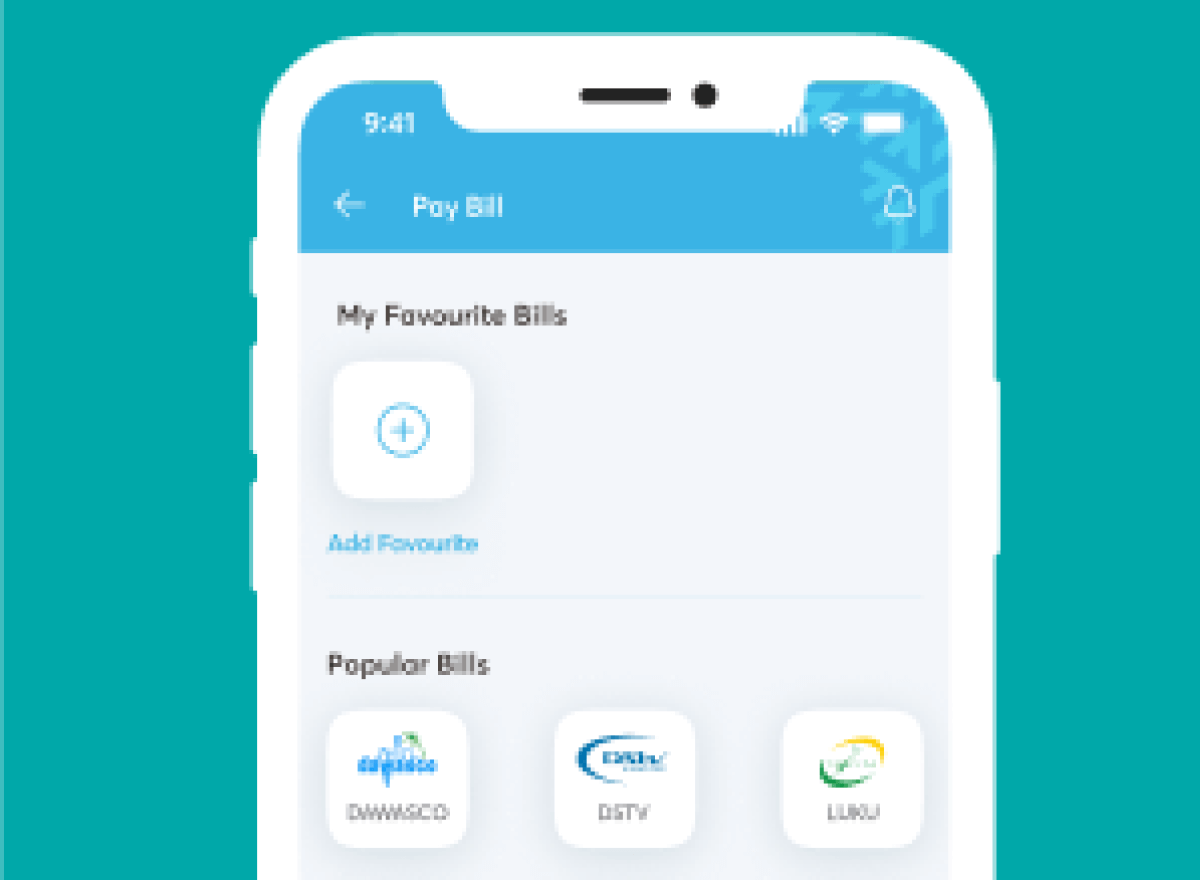

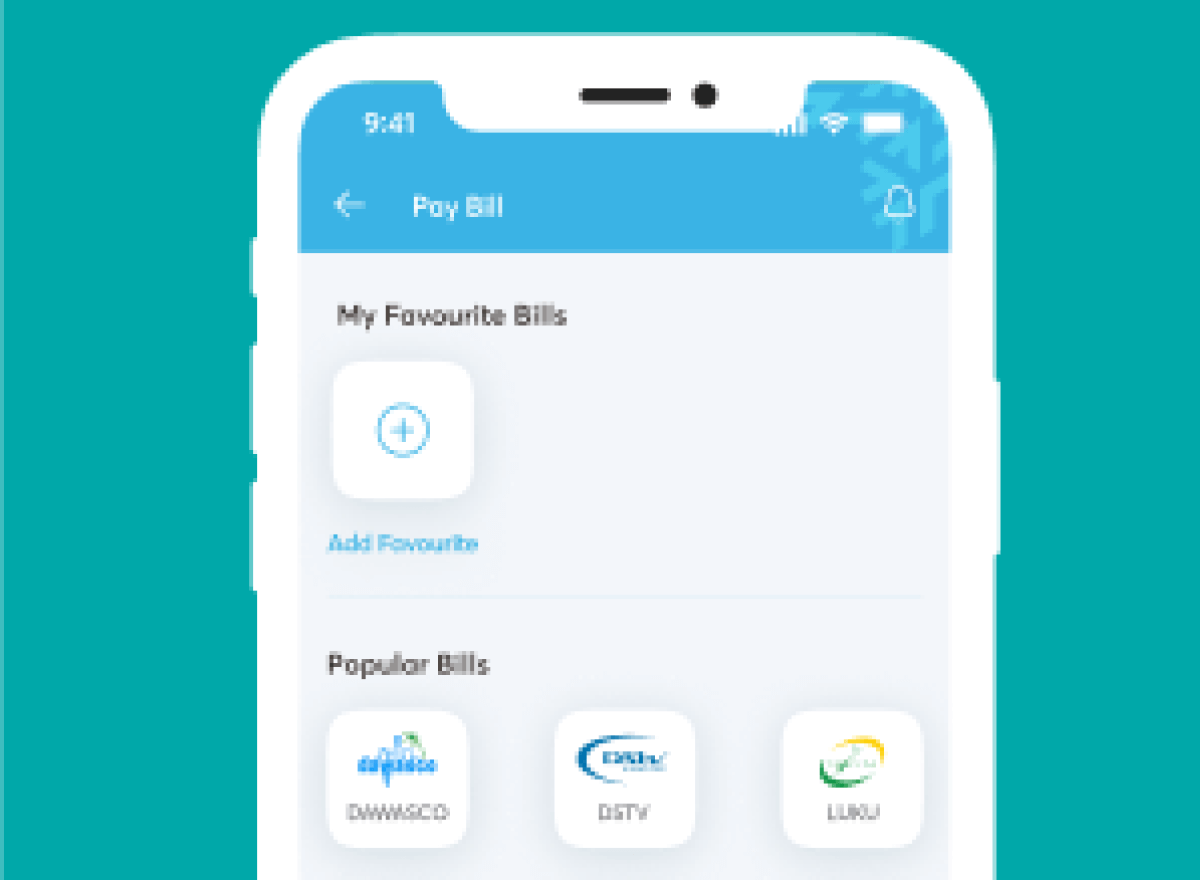

Quick Bill Payments

Pay utilities, school fees, and subscriptions effortlessly through the app, saving you time.

Instant Mobile Loans

Get quick financing straight to your account for unexpected expenses or personal goals.

Smart Card Management

Control your NCBA cards, set limits, and block or unblock them for extra security.

Easy Investment Access

Manage investments and Unit Trust funds directly in the app to grow your wealth.

Advanced Security

Stay protected with biometric login, device registration, and real-time security features.

How to Upgrade to NCBA Now

Follow these steps to upgrade and enjoy seamless banking

- Open the Google Play Store or Apple App Store and search for “NCBA Now”.

- Select the NCBA Now app from the search results.

- Tap “Update” to install the latest version.

- Wait for the update to be completed.

- Launch the app and start banking instantly.

Internet Banking

Bank like a boss, wherever you are. The NCBA Now app puts the power of a full-service bank in your pocket. Managing your finances should be simple, secure, and seamless. That’s exactly what NCBA Internet Banking offers. From quick money transfers to investment tracking, bill payments, and instant loans, our platform gives you complete control over your banking—anytime, anywhere. Here’s how it makes your life easier:

Real-time Account View

See your account activity instantly, so you always know where your money stands.

Bill Payments Made Easy

Make payments for all your utilities and recurring purchases with ease.

Effortless Money on the Move

Transfer funds, pay bills, and top up your phone. It’s all here, in one convenient location.

Mobile Money

- Easily transfer funds between your NCBA account and mobile money platforms such as M-Pesa and Airtel Money. Enjoy the convenience of accessing your money anytime, whether you’re sending funds, paying bills, or topping up your account.

Payments

- Bill Payments

Stay on top of your monthly expenses by paying bills directly from your NCBA account. Through Internet Banking, you can settle payments for:

- Utilities: Pay for electricity (KPLC Prepaid & Postpaid), water bills (Nairobi Water and other providers), and internet services (Zuku, Jamii Telkom, Safaricom Home).

- Entertainment: Pay for DSTV, StarTimes, GoTV, and other TV subscriptions.

- Government services: Settle iTax payments and pay for government-related services.

- Insurance premiums: Ensure your policies remain active by making timely payments to supported insurance providers.

2. Insurance Payments

Easily pay your insurance premiums through NCBA Internet Banking. The platform supports various insurance providers, allowing you to make secure and timely payments without the hassle of visiting a branch. This ensures that your insurance policies remain active and up to date.

3. eCitizen Payments

Conveniently pay for eCitizen government services directly from your NCBA account, ensuring smooth transactions for your government-related needs.

4. Expressway Payments

For frequent road users, the Expressway Payment feature allows you to top up your Nairobi Expressway toll account directly from NCBA Internet Banking and ensure smooth and uninterrupted travel, eliminating the need for manual cash payments.

Investments

NCBA Internet Banking provides a user-friendly platform to manage your investments with ease. Through the Invest NOW feature, you can:

- View your Unit Trust portfolio and track its performance in real time.

- Make additional investments to grow your wealth.

- Withdraw funds from your investment account when needed.

- Access expert insights to make informed investment decisions.

Whether you’re a seasoned investor or just getting started, this feature helps you take control of your financial future.

Internet Banking Loans

Apply for personal loans directly through Internet Banking with a fast and secure process. Get instant access to:

- Mobile Loans: Short-term financing with amounts up to Kshs. 70,000 and a 30-day repayment cycle.

- Digital Personal Loans (LFA): Borrow up to Kshs. 1,000,000 with flexible repayment periods of up to 12 months.

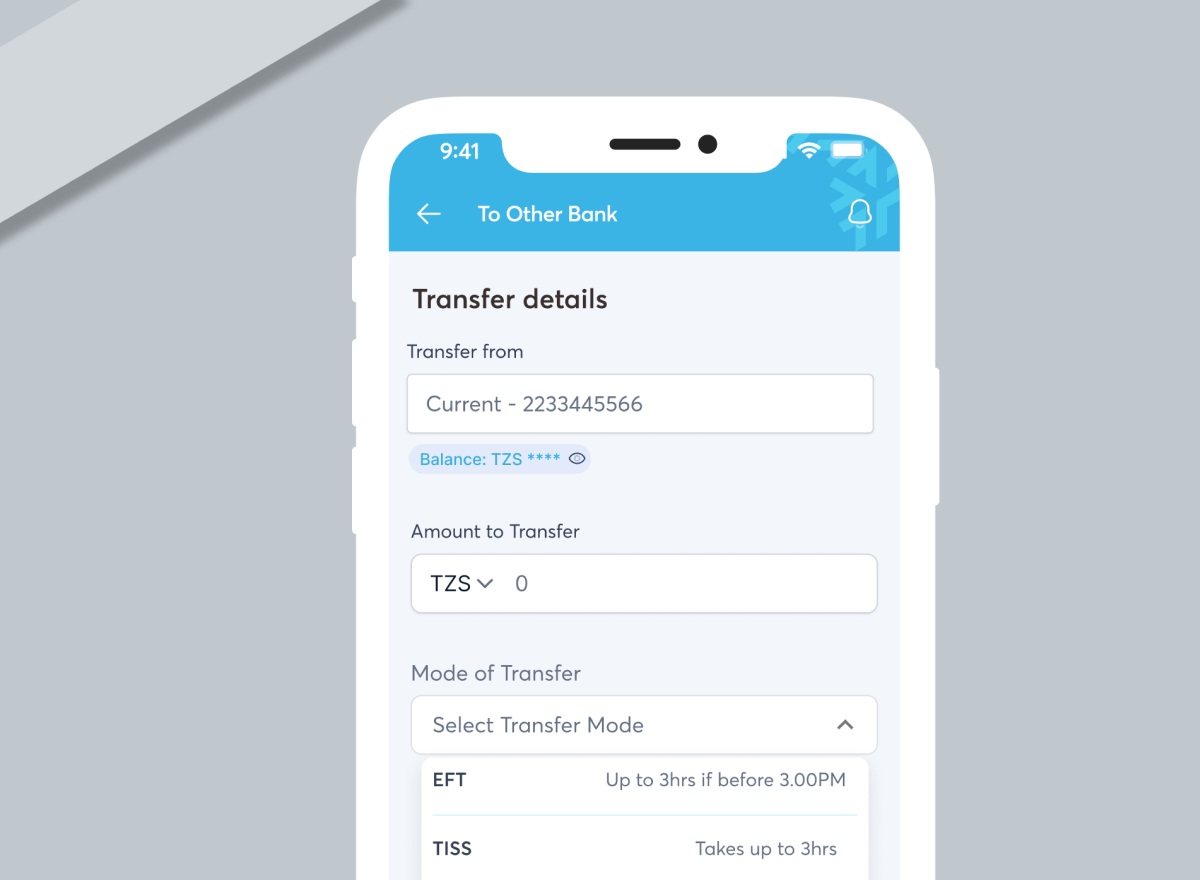

Transfers

Bank to Bank Transfers

Seamlessly transfer money within your NCBA accounts, to other NCBA customers, or to different banks via multiple channels, including:

- Electronic Funds Transfer (EFT)

- Direct Deposits

- Real-Time Gross Settlement (RTGS)

- PesaLink

- Loop and Mshwari

Instant M-Pesa to Bank Transfers

Need to move money between M-Pesa and your NCBA account? With just a few taps, you can:

- Transfer money from M-Pesa to your NCBA account instantly

- Withdraw funds from your NCBA account to M-Pesa anytime

It’s seamless, fast, and secure.

Lipa na M-Pesa

Internet Banking enables you to conveniently make payments via M-Pesa services directly from your NCBA account. You can:

- Pay to M-Pesa Paybill numbers for various service providers.

- Use Buy Goods and Till numbers for seamless shopping and payments.

- Avoid transaction delays by paying directly from your bank instead of transferring money to your mobile wallet first.

My Cards

Control your debit and credit cards through Internet Banking. You can:

- Set or change your card PIN

- View card balances

- Pay your credit card bills

Airtime Purchase

- Top up your mobile phone or send airtime to others directly from your NCBA account. Available for Safaricom, Airtel, and Telkom users, this feature ensures you never run out of airtime.

Foreign Exchange (FX NOW)

FX NOW is an integrated foreign exchange service that allows you to buy and sell foreign currency directly through NCBA Internet Banking. Key features include:

- Real-time exchange rates – View live forex rates before making a transaction.

- Instant transactions – Convert currencies and manage your forex needs effortlessly.

- Multi-currency support – Trade in major global currencies such as USD, EUR, GBP, and more.

This feature is ideal for individuals and businesses managing international transactions or foreign currency investments.

Pesalink

Tired of waiting for banking hours to send money?

PesaLink is a real-time payment service that allows you to send money directly to any Kenyan bank account, mobile number, or debit card.PesaLink transactions are instant and available 24/7. You can send up to Kshs. 1,000,000 per transaction, making it perfect for urgent payments, salary disbursements, or high-value transactions.

Service Requests

- NCBA Internet Banking simplifies banking by allowing you to request various services online without visiting a branch. These include:

- Checkbook requests – Order a new checkbook at your convenience.

- Banker’s cheque – Request for a banker’s cheque for official payments.

- Full account statements – Access detailed transaction history and download statements for record-keeping.

Handle your banking needs wherever you are without stepping into a branch.

Dedicated Relationship Manager

For a more personalized banking experience, NCBA Internet Banking allows you to access details of your assigned Relationship Manager. You can view their contact information and reach out for expert financial guidance, loan assistance, or any banking inquiries, ensuring that your needs are handled with a personal touch.

NCBA USSD Mobile Banking Service

Seamless Banking, Anytime – No Internet Needed

NCBA’s USSD Mobile Banking Service provides a fast, secure, and efficient way to manage your finances directly from your mobile phone—without the need for an internet connection. Whether you need to check your balance, transfer funds, pay bills, or apply for a loan, everything is just a few keystrokes away.

How to Get Started?

Getting started with NCBA’s USSD banking is simple and takes just a few steps

- Dial 488#: Access the NCBA USSD menu from any mobile phone.

- Enter Your Secure PIN: Authenticate yourself by entering your four-digit PIN.

- Set Up Security Questions: Enhance your account security by setting up security questions and answers.

- Start Banking Instantly: Navigate through the easy-to-use menu and access the services you need.

Features

With NCBA’s USSD service, you have access to a wide range of essential banking functions, ensuring that you stay in control of your finances at all times:

Account Management

- Balance Inquiry: Check your real-time account balance instantly.

- Mini-Statements: View your most recent transactions and track your spending.

- Account Settings: Manage your account preferences and update personal details.

Funds Transfers

- Internal Transfers: Transfer money between your NCBA accounts effortlessly.

- Interbank Transfers: Send funds to other local banks using PesaLink or EFT.

- Mobile Money Transfers: Move money securely between your NCBA account and M-Pesa.

Bill Payments

- Utility Bills: Pay for electricity, water, and other essential services.

- TV & Internet Subscriptions: Settle payments for DStv, Zuku, and other providers.

- Insurance Premiums: Keep your insurance coverage active with timely payments.

Airtime Purchase

- Self & Third-Party Airtime: Buy airtime for yourself or send to family and friends, directly from your NCBA account.

Loan Services

- Loan Application: Apply for an instant NOW Loan and receive funds instantly.

- Loan Repayments: Easily make repayments on active loans to stay on track.

- Loan Status Inquiry: Check your loan balance, outstanding payments, and eligibility for new loans.

Enhanced Security Features

NCBA prioritizes the security of your transactions with multiple layers of protection:

- Secure PIN Authentication: Every transaction requires your secret PIN for verification.

- Security Questions Setup: Add an extra layer of protection against unauthorized access.

- Real-Time Alerts: Receive SMS notifications for all transactions made via USSD.

Why Choose NCBA USSD Banking?

- Available 24/7: Perform transactions at any time, including weekends and holidays.

- Instant Processing: Transfers, bill payments, and loan disbursements happen in real-time.

- Easy Navigation: A user-friendly interface ensures smooth access to all services.

- Maximum Security: Multi-layered security measures protect your funds and personal data.

- Works Without Internet: No data or Wi-Fi required, making it accessible anywhere.

See other banking solutions

Covering all financial needs end to end