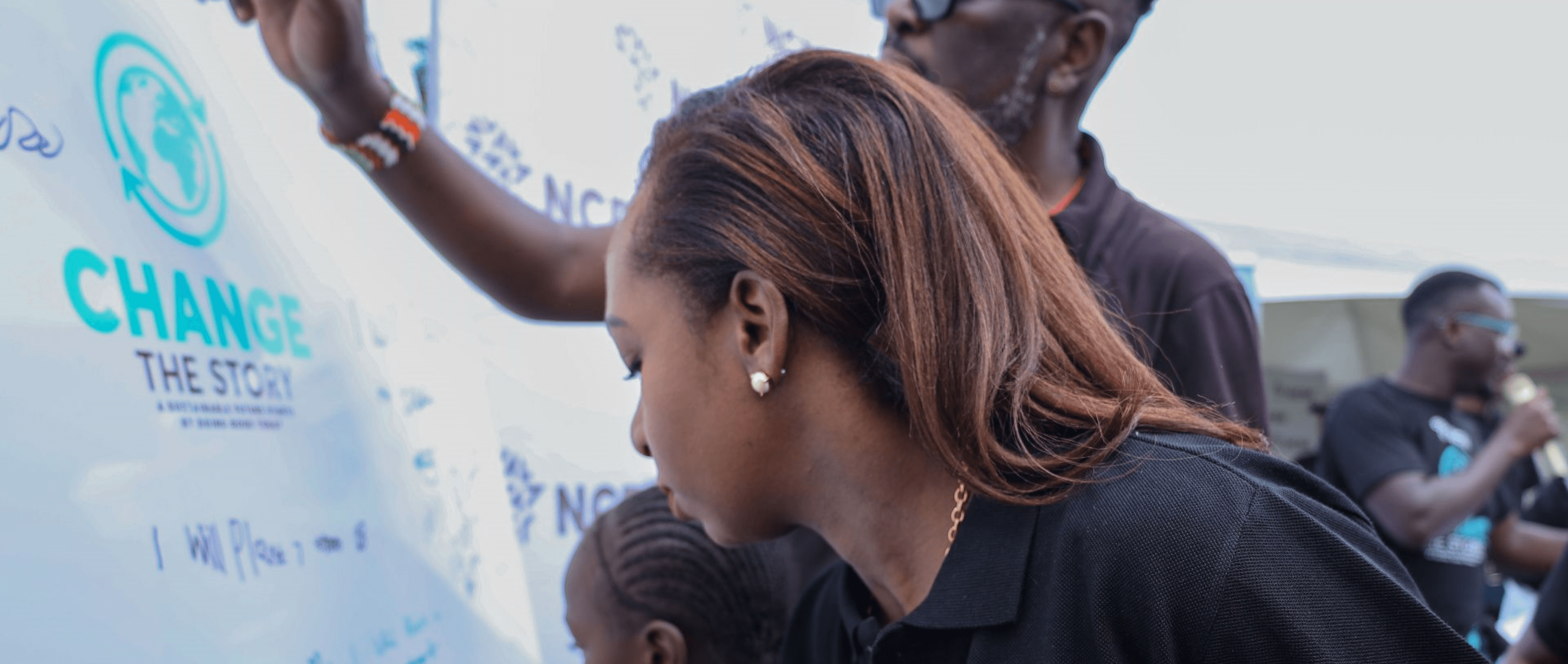

NCBA Bank hosted the Daring Returnees Forum in partnership with Chams Media Ltd.

The engagement provided a platform for Kenyans to explore investment opportunities, share their experiences, and contribute to the country’s economic development through skills, knowledge, and wealth transfer.

In addition, attendees gained valuable insights from industry experts, successful returnees, and thought leaders, helping them navigate the reintegration process and capitalise on Kenya’s dynamic economic landscape. They also had an opportunity to network with industry professionals, leaders, and potential investors.

As a leading financial institution, NCBA showcased its revamped comprehensive suite of services designed to support diaspora returnees, including loan facilities, investment advisory, and other tailored banking services.

“We are excited to have supported The Daring Returnees Forum 2024,” said Mr. Tirus Mwithiga, NCBA Group Retail Banking Director. “This event aligns perfectly with our mission to enhance financial inclusion and empower Kenyans returning home. The Bank has revamped its diaspora banking value proposition to provide financial solutions that cut across the unique needs of individuals in the diaspora at every stage of their journey that is; those relocating to the diaspora, those already at the diaspora and those returning from the diaspora. We look forward to showcasing how NCBA can assist returnees in achieving their financial and investment goals,” he added

The Kenyan diaspora community plays a crucial role in Kenya’s socio-economic development, contributing approximately $3 billion in remittances annually, which accounts for about 3% of the country’s gross domestic product (GDP).

“We are delighted to support Kenyan returnees as they reintegrate into the country and continue making impactful contributions to our nation’s development. The diaspora community not only fuels our economy through remittances but also brings back invaluable skills, knowledge, and global perspectives that drive innovation and progress. At the Ministry, we are committed to strengthening partnerships that create more opportunities for returnees, ensuring they thrive and play a key role in building a prosperous Kenya.” Said Ambassador Hellen Gichui during the forum.

Beyond financial support, returnees also bring invaluable skills and knowledge. The Daring Returnees Forum 2024 celebrated their bold decision to return and reintegrate into Kenya, highlighting their significant contributions across various economic sectors.

The Daring Returnees Forum 2024 was a tribute to the courage and determination of Kenyans returning home to make a difference. Their investments and expertise are not just vital but instrumental in shaping Kenya’s future. The Bank through its partnership with Chamz Media is keen to provide a platform for them to share their experiences and contribute to our country’s growth.

NCBA remains committed to continue supporting and empowering the Kenyan diaspora, fostering economic development, and driving innovation. The Bank has established strategic partnerships that elevate the Diaspora Banking value proposition.

Through this, NCBA continues to be the preferred financial partner for Kenyans returning home from abroad by providing advisory and support towards achieving one’s financial goals when they get back home. In addition, the Bank has facilitated international money transfer services through strategic partnerships with Fintechs and Money Transfer Service Providers, such as Western Union and Money Gram, which provide rails for Diaspora Remittances back home.

The Bank has further partnered with Real estate developers/stakeholders to support the Kenyan diaspora in owning property back home. Through these collaborations, NCBA ensures that all aspects of our clients’ transitions abroad or relocating back to Kenya, are smoothly and effectively managed.